FAQ for a First-Time Homebuyer

Purchasing a home is a major decision that is likely to influence your potential both financially and in terms of your overall lifestyle. The procedure for purchasing a house can be daunting and there are many choices to make, but taking every step with care and consulting experts can make your home buying experience a pleasant one.

Why Not Rent?

Purchasing a house has many significant advantages over renting. Besides having management of your living area and the capability to make modifications at will, you’ll also be building equity. Even before you repay your mortgage, you could be able to sell your home for more than you paid for it, giving you a profit and creating a chance to transfer up to a bigger home in a better neighborhood. Building equity also provides you something to borrow for future expenses, which isn’t possible when you’re renting.

What Can I Afford?

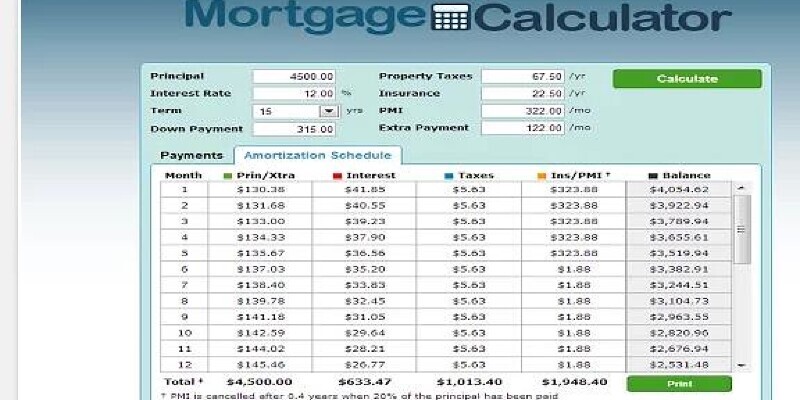

The question of a homebuyer’s cost range is a difficult one. The answer is dependent upon many factors, such as income, job stability, savings, debt and the terms of the mortgage. 1 rule of thumb states that a house must cost no more than two-and-a-half occasions the buyer’s annual income. However, real estate agents and lots of websites use more complex formulas to variable in a purchaser’s personal financial situation and decide an affordable price for a home.

What Are the Costs?

Purchasing a house requires buyers to cover two chief expenses. The first is a down payment. A normal down payment on your house is 20 percent of the total value, but a few mortgages may allow down payments as low as 3%. Another significant expenses for buyers are closing prices. Closing prices cover the loan processing fee to get your mortgage, the title fees and transfer to get a surveyor or deed processing from the local government offices. Closing prices also vary based on the cost of the home, but frequently amount to several thousand dollars.

How Can I Pick a Mortgage?

Choosing a mortgage is more complicated than simply looking for the cheapest interest rates. Some mortgages feature a fixed rate of interest, but others have a rate that may change over time. These adjustable rate mortgages, or ARMs, frequently feature a low introductory interest rate but rise to substantially higher rates. Make sure to read the fine print, as creditors are required by the Truth in Lending Act to disclose when and how frequently they can alter your rate of interest along with what your maximum monthly payment may rise into later on.